Reconcile Credit Card Accounts In Quicken For Mac 2015

- How To Close Credit Card Accounts In Writing

- Reconcile Credit Card Accounts In Quicken For Mac 2015 System Requirements

- Credit Card Accounts In Quickbooks

Adobe photoshop elements 8.0 keygen. There may be occasions when dealings that were currently reconciled will show as unreconciled. Right here are usually some of the possible causes:.

How To Close Credit Card Accounts In Writing

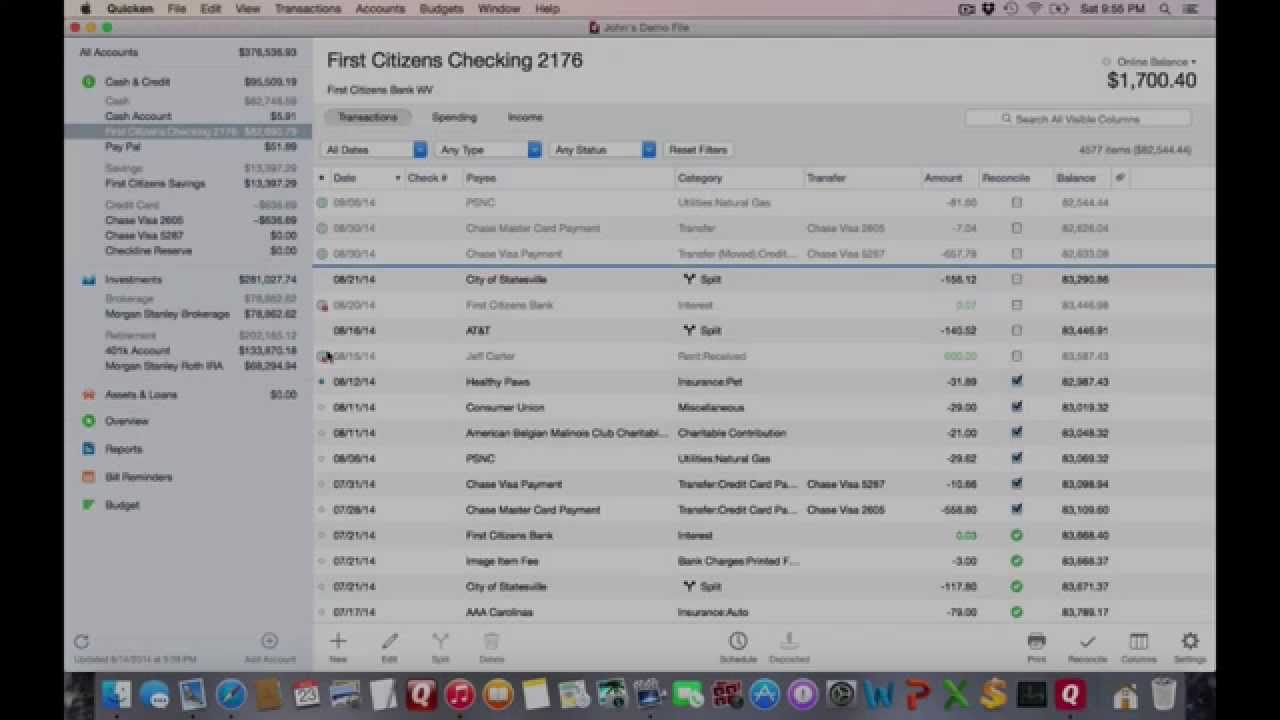

Reconcile a credit card account Follow the steps above to reconcile a bank account but choose your credit card account instead. After you click Reconcile Now in the Credit Card reconciliation window, you will be asked to create a Payment Check or Create a Bill to Pay Later. Select the account you want to reconcile on the left in the Account Bar. Enter all of your transactions that occurred since the date of the opening balance transaction. From your account register, select the Actions gear icon at the very top of your register (Ctrl + Shift + N) Then choose Reconcile. Using your account statement, check the amount in the Opening Balance field. The first time you reconcile an. Reconcile a Credit Card Account. Register toolbar or choose Accounts > Reconcile Account from the Menu Bar. Quicken for Mac 2015 or newer, Quicken for Mac. For more than ten years, Quicken has been able to reconcile your credit card account (and any other account) without this snidbit of data, but in Quicken 2015, it is now requesting this info. 6 Enter the monthly interest charge by using the Finance Charges text box.

Undo Final Reconciliation has been clicked. The reconciled transactions were transformed or erased. The cleared transactions had been unchecked (uncleared) in the account register. Money were moved from a formerly reconciled lender accounts to its bass speaker accounts. The firm file provides been transformed between QuickBooks for Mac and Windows or between QuickBóoks Online and desktop computer (is applicable to US just). The transactions were never ever reconciled in the corporation document (perhaps a backup was restored and overrode the document where the reconciled dealings existed). Whatever the reason can be, you must ré-reconcile the dealings.

A small reconciliation or specific reconciliation should help you complete this task with simplicity. There are two strategies available for completing this process.

Choose the technique appropriate for the scenario. Method 1 This method uses an 'off-cycle' reconciliation date and need that you understand the finishing balance from the almost all recent reconciliation. Reconcile a standard bank accounts. From the Banking menu, select Reconcile.

Select the Account you need to reconcile. In the Date of Statement field, get into a date for an 'óff-cycle reconciIiation.' This date can end up being any day between the last and the following planned reconciliation. Take note: Using an 'off-cycle' date will remind customers that a mini reconciliation is usually being utilized to place earlier unreconciled dealings back without influencing the 'period' that they adhere to. In the Closing Balance field, get into the stability of your final profitable reconciliation after that click Continue.

ln the Reconcile home window, check off the transaction/s you are usually re-reconciling. Be sure that the Difference field displays $0.00 after that click Reconcile Right now. Overcome a credit card accounts. Follow the ways above to reconcile a lender account but select your credit card accounts instead. After you click on Reconcile Today in the Credit score Cards reconciliation windowpane, you will be requested to make a Payment Check or Create a Bill to Spend Afterwards.

Select choice to Generate a Costs. After publishing the Reconciliation Statement (if desired), a costs seems on display for the Credit score Cards. The quantity on the bill will be the balance you simply reconciled. Click on Crystal clear at the lower right side of display. This eliminates all info from the costs.

Near the Costs Window. A costs is not really created and it will not have an effect on your credit card stability. Technique 2 This technique uses a time various other than the almost all recent reconciliation and does not require that you understand the ending balance from the prior reconciliation.

Get back together a bank accounts. From the Bank menu, click Reconcile. Choose the account you require to reconcile. In the Day of Statement field, enter an off-cycle time within the statement period on which the purchase appeared. This guarantees that the purchase seems in the proper reconciliation statement period. In the Ending Balance field, get into $1.00 after that click Continue.

This wikiHow teaches you how to find out whether or not your iPhone is carrier-locked. The easiest way to do so is by calling your carrier and asking whether or not your iPhone is unlocked, but there are a couple of other ways you can approximate your iPhone's lock status. Consider just calling your carrier. How do i know if an iphone is unlocked. It's not possible to tell, just by looking at the handset, whether an iPhone is locked or unlocked: Apple does not allow other phone companies to brand iPhones. (You don't get Three- or EE-branded.

Note that $1.00 is certainly an human judgements physique to allow you start the reconciliation and will end up being improved in a later on step. In the Reconcile window, verify off the purchase/s that you are re-reconciling.

Consider note of the Cleared Balance quantity at the bottom level right. Click on the Modify button to reopen the Begin Reconciliation window. Copy the Removed Stability into the Closing Balance field after that click Continue. The Difference will right now become zero. Click the Reconcile Now button. Get back together a credit card account. Adhere to the exact same treatment for reconciling a loan provider account but select your credit card account.

When you click on Reconcile Right now, QuickBooks will display a information.

Updated September 16, 2018 When you, you obtain a purchase register where you can instantly or manually enter activities that impact the balance in your account, such as buys and obligations. You possess the choice of altering your account register choices in to improved satisfy your needs. For instance, you may desire to automatically spot the decimal stage in a particular spot, change out reconciled dealings, show dates before check amounts, or actually alter the fonts and colors utilized. Some of the options accessible for customizing your accounts preferences in Quicken for Home windows 2016, 2017, and 2018 appear below. In order to make any of these adjustments, select the Edit menu in Quicken. Following, click Register in the remaining pane.

Reconcile Credit Card Accounts In Quicken For Mac 2015 System Requirements

You can after that make your modifications in the correct pane and click Okay to save those adjustments. Notice: Some of these options don't work for expense accounts, since purchase transaction lists put on't work the exact same way as normal account registers.

By The Reconcile: Checking window is fundamentally just two lists: one of accounts withdrawals and one of account build up. The home window also shows some additional details at the underside: the Removed Stability (which is your account balance like only those transactions that you or Quicken have got proclaimed as removed), the Declaration Ending balance, and the Difference between these two statistics. Marking healed assessments and remains You need to inform Quicken which remains and investigations have cleaned at the bank. (Refer to your loan company declaration for this details.) To do so, follow these steps:. Identify the first deposit that offers cleared. Simply leaf through the loan company statement and find the first deposit listed.

Tag the very first cleared deposit as removed. Scroll through the transactions listed in the perfect column of the Reconcile: Checking windows, find the deposit, and then mark it as healed by clicking on it. Quicken places a check mark in front of the deposit and improvements the removed statement stability. Record any removed but missing remains. If you can't discover a deposit, you haven't got into it in the Quicken sign up yet.

Come back to the Quicken sign up by clicking on the Edit switch and then get into the down payment in the register in the usual way - but type m (for cleared) in the Clr line. This mark recognizes the deposit as one that's already cleared at the loan provider. To return to the Reconcile: Checking home window, click on the Return to Reconcile switch. Repeat Actions 1-3 for all deposit listed on the bank or investment company statement.

Identify the 1st check or some other drawback that offers healed. No sweat, right? Just discover the 1st check or disengagement listed on the bank or investment company statement. Mark the very first cleared check or various other drawback as cleared.

Scroll through the dealings shown in the still left column of the Reconcile: Checking windowpane, discover the first check, and select it to indicate it as getting healed the bank. Quicken inserts a check out mark to content label this transaction as cleared and up-dates the Cleared Balance. Report any missing but cleared assessments or withdrawals. lf you cán't discover a check out or withdrawal - think what?

- you haven'testosterone levels moved into it in the Quicken sign up yet. Display the Quicken sign up by clicking on the Edit switch. Then get into the check out or drawback in the register.

Be certain to kind chemical (for cleaned) in the Clr column to identify this check or drawback as one that'beds already cleared the loan company. To come back to the Reconcile: Checking windows, click the Return to Reconcile switch. Repeat Steps 5-7 for withdrawals shown on the lender statement. Producing sure that the distinction equates to zero After you tag all the removed bank checks and deposits, the distinction between the cleared stability for the account and the bank or investment company declaration's finishing balance should even zero. The body displays a Reconcile: Checking windows in which everything is certainly hunky-dory, and existence is great.

If the difference does similar zero, you're done. Just click on the Done button to inform Quicken that you're done. Quicken shows a congratulatory message telling you how very pleased it can be of you; then it demands whether you would like to print a Reconciliation statement. As component of the finishing-up process, Quicken changes all thé cs tó Rs.

Thére's no excellent magic in this change. Quicken can make the changes to identify the dealings that have got already become reconciled. Can'testosterone levels choose whether to print out the Reconciliation record? Unless you're also a business bookkeeper or án accountant reconciling á standard bank accounts for someone else - your company or a client, for example - you don't want to print the Reconciliation statement. All printing does is usually demonstrate that you reconciled the accounts. (Generally, this proof will be the reason you should printing the record if you are a bookkeeper ór an accountant; thé person for whom you're reconciling the account will understand that you do your job and will have got a piece of document to arrive back again to afterwards if he or she provides questions.) If the distinction doesn't similar zero, you have a issue. If you click Done, Quicken shows a information box that provides some cursory details as to why your account doesn't balance.

Credit Card Accounts In Quickbooks

Then, if you show that you would like to soldier on in any case, Quicken displays the Adjust Stability dialog box. This discussion box informs you, in impact, that you can force the two amounts to agree with the fact by clicking the Adjust button. Making the two amounts to agrée isn't á extremely good concept.

To perform so, Quicken adds a removed and reconciled transaction equivalent to the difference. If you wish to reconcile later without preserving your unfinished work, click on Cancel in the Reconcile: Checking windowpane and after that click Yes when Quicken asks you whether you really need to give up without saving your function. The following time you click on the Reconcile button, you'll have got to start over from nothing. If you can't get your account to reconcile but would like to save your function, click on the End Later switch.

Quicken results in your reconciliation function basically smaller portion done. The transactions that you designated as healed still display c in the Clr industry, and you still have an unexplainable distinction between the loan company declaration and your register. Either way, postponing a reconciliation and not really choosing to alter the bank account balance is usually the greatest technique because it allows you to locate and appropriate problems. After that you can reboot the reconciliation and finish your function.

(You restart a reconciliation in the same way that you originate one.).